As a business owner you need to know and understand some key terminology. This includes terms like return on sales (ROS). If you don’t know why it’s important you could be missing out on some key metrics that can help you boost your business.

In this guide we’ll look at how to calculate the formula, and one golden tip that you can implement in your business.

Let’s jump straight into the details.

What is Return on Sales?

Return on sales (ROS) is a percentage that tells us how much profit a company earns from its sales.

Example: If a shop sells a shirt for $100 and has a ROS of 5%, then they've earned $5 in profit from that sale.

ROS gives an overview to understand how well a company turns sales into profit. It’s a useful measurement for getting a quick sense of a company's financial health.

- If the percentage is high, the company is doing a good job of keeping costs down and maximizing profits from each sale.

- If it's low, the company may be spending too much to generate sales or might face other challenges.

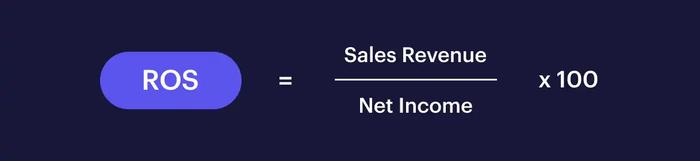

How to calculate return on sales

To calculate ROS, you divide the company's net income by its sales revenue and then multiply the result by 100 to give you a percentage.

Calculate return using this sales formula:

ROS = Sales Revenue / Net Income × 100%

But there’s one more metric worth mentioning here: gross profit margin.

It is a way for analysts to assess the financial health of a company. Gross profit margin consists of profit minus the cost of goods sold (COGS).

What is a good rate of return on sales?

A good rate of return on sales often sits between 5% and 10%. It's not a strict indicator though, as the percentage can vary based on the industry. Generally, if a company is above this range, they're doing quite well. If they're below, there might be some room for improvement.

Industry-specific benchmarks for return on sales

How does your return on sales compare to others in your industry? Understanding industry-specific benchmarks helps set realistic expectations and identify areas for improvement. Here’s a quick breakdown of return on sales ratio averages across key sectors:

- Retail → With lower operating margins, retail businesses often see ROS ratios between 2% and 5%, heavily influenced by high operating expenses and competitive pricing.

- SaaS → SaaS companies typically achieve ROS ratios of 15% to even 25%, thanks to scalable operating income models and lower operating costs relative to revenue.

- Manufacturing → Manufacturing firms range between 8% and 12% in ROS, as higher operating costs for materials and labor impact their profitability.

The differences are mainly due to operational efficiency and sales process structures. For instance, SaaS relies on recurring revenue, which stabilizes net income, while retail faces more volatile net revenue due to seasonal trends.

Comparing your income statement against these benchmarks lets you identify opportunities to cut operating expenses or optimize your sales formula.

Best practices to improve return on sales

Here is a list of the best practices when it comes to improving your return on sales. Follow them to maintain ROS beyond the usual scope.

1. Use customer segmentation

Customer segmentation is like sorting your friends based on what they like. It helps you know what their preferences are and what they have in common.

Rather than approaching everyone with the same sales strategies, you can divide your clients into smaller groups based on shared characteristics or behaviors.

An example: A software company might find that enterprise-level clients are more likely to opt for premium packages.

Special promotions or personalized services can then be directed towards this high-value segment. The result is often a spike in sales and, consequently, a better return on sales.

Customer segmentation means you don’t waste dollars on low-impact areas, and your clients get what they want. A win-win situation.

2. Leverage existing customer relationships with upsell and cross-sell

You've already earned the trust of your current clients, so why not offer them more? Don't miss out on sales opportunities. Use upselling and cross-selling. It’s a tactic for boosted return on sales that works.

An example: An experienced user buys a laptop from a technology company. Instead of ending the transaction there, the sales team might suggest a compatible high-end software package (upselling) or recommend a protective laptop case (cross-selling).

This strategy is rooted in understanding what customers want. On top of that, this approach raises the business's operating profit without adding new expenses.

3. Adjust prices based on demand and competition

Smart pricing goes beyond setting a number and forgetting it. The secret here is to adjust prices based on demand and competition.

An example: A trendy coffee shop in a bustling city area notices increased demand during specific hours. Or sees a competing coffee shop raise its prices. They might adjust their own prices a bit higher. Yet, if the opposite occurs and demand drops, lowering prices might draw more customers in.

Be as dynamic as the market is.

Such pricing strategies directly influence net sales and affect both the company's operating profit and net revenue. This doesn't mean constant price fluctuations, but rather having a pulse on the market.

Businesses need to understand where they stand in the same industry and be ready to adapt.

4. Optimize stock levels to reduce holding costs

Carrying a surplus of inventory might seem harmless, but it quietly eats into profits by incurring holding costs. And here’s why:

An example: If a fashion retailer orders too many summer dresses and the season turns out cooler than expected, they're left with excess stock and unsold goods. This not only ties up cash flow but also incurs inventory costs, which directly impacts the operating profit margin.

So how do you strike the right balance? Integrating sales figures, sales volume, and historical sales data should give business owners a clearer picture.

The goal is clear: having just enough to meet demand and maximizing sales revenue without unnecessary expenses. Don't just sell, stock smart.

5. Streamline operations to cut expenses

High holding costs mean more operating expenses, which drain the operating profit. Let’s see this in practice.

An example: A local bookstore orders heaps of a new release and expect it to be a bestseller. If the book doesn't sell as projected, they're left with mounting inventory costs. These unsold items impact net sales and the company's profitability.

The best course of action here would be to lean on sales figures from the past in order to forecast future demand. Companies in the same industry might have experienced similar stock issues and could provide insights.

Use technology to monitor sales volume and sales team performance, as well as to guide stocking decisions.

Every unsold item represents not just lost sales revenue, but also money spent on goods that didn't produce a return. Proper stock optimization means increased cash flow and stronger financial statements for the company.

6. Analyze data for actionable insights on sales trends

Every transaction, customer interaction, and sales effort produces valuable data points. They also give perspective on what drives net sales and ROS.

An example: An online fashion retailer observes that certain colors or styles spike in sales during specific seasons. This insight, drawn from analyzing sales figures, helps guide future stocking decisions.

And for those in competitive markets, monitoring and analyzing a competing company's performance provides comparative benchmarks.

So keeping a close watch on operating expenses, operating income, and operating profits reveals how well the company is able to turn sales into actual profit.

7. Develop sales teams' closing skills

Closing skills are essential for understanding what the customer wants and adapting accordingly.

An example: A software-as-a-service (SaaS) business observes that potential clients often back out at the final stages of the sales process. Digging deeper, they find that the sales team often rushes to close without addressing all client concerns.

How can you prevent it?

Training programs help sales teams tackle objections and boost their operating margins. They also give the bigger picture of business operations.

The outcome?

The company generates higher revenue because the sales team learns how to navigate the sales cycle, reducing sales return instances.

8. Implement loyalty programs and engagement strategies for customer retention

Appreciate your loyal clients! Such programs will make them stay.

An example: An online clothing store, observing consistent purchases from a segment of their customer base, introduces a loyalty program. They offer early access to new collections. Customers love exclusivity because it makes them feel special, and this keeps them coming back.

Loyalty strategies don't just translate to a boost in total revenue – they also strengthen sales forecasting, inventory management, and production cost management.

9. Post on multiple channels and reach a wider audience

Better segmentation, a bigger customer base, improved net sales, and boosted return on sales all come from multi-channel posting.

An example: Consider a mid-sized marketing agency that specializes in branding solutions for small businesses. While they've mostly been operating through referrals and traditional networking events, they’ve now decided to expand their strategy.

They initiate an integrated campaign by sharing insightful articles on LinkedIn, hosting webinars on industry trends, creating engaging clips for TikTok, and collaborating with influencers on Instagram.

Okay, but where to post? First, check which platforms your buyer personas use and be present here where your clients want to be noticed. Posting on different social media platforms (among other places) directly elevates your sales ratio due.

Why so?

The wider the reach, the greater the chances of converting passive viewers into active customers.

10. Improve your inventory planning with predictive analytics

Stock management shouldn't be reactive. Instead, it should anticipate future demand and adjust accordingly. Predictive analytics is used by modern businesses to optimize this very aspect of their operations.

An example: Let’s take a popular electronics manufacturer. Data shows them that there's a spike in demand for certain accessories within the following two months every time a new gaming console launches. Using predictive analytics, they forecast this demand peak and strategically manage their inventory, thus avoiding stock outs and lost sales.

Decisions like these directly affect the operating margin ➡️ there’s a minimized mismatch between demand and supply. Too much inventory may bring high operating costs and even potential interest expense if it’s purchased on credit.

11. Maintain high product standards to boost net sales

High-quality products are a mark of pride, no doubt about it. But they also help reduce returns and customer complaints, whilst simultaneously enhancing net sales.

An example: If a tech gadget store’s products meet customer expectations every time, the trust factor grows. As trust builds, customers are more likely to make repeat purchases and recommend the brand, increasing net sales. The fewer returns they have to process, the better their operating profit margin becomes.

Keep a keen eye on product standards. You’ll see that it pays off after seeing your operating income, as returns can quickly hurt profitability.

12. Optimize the operating profit margin through KPI analysis

Regular tracking and analyzing key performance indicators (KPIs) give companies insights into what's working and where some tweaks are necessary.

An example: An online bookstore might notice a particular marketing campaign drove significant traffic but that it didn't convert to many sales. This insight helps them tailor their sales efforts and, ultimately, increase return on sales.

Before you start the analysis, you need to know what KPIs are best to keep an eye on. There’s no one-size-fits-all answer to this question; to choose yours, consider your business goal and go for metrics that provide actionable insights directly tied to that objective.

There’s one more thing to make your financial ratio better.

How can Capsule CRM to maximize your return on sales?

You need to develop good relationships with your customers if you want a high return on sales ratio.

The best way to go about it is using a solid tool for it.

Meet Capsule CRM.

Why should you consider using Capsule CRM? Let's break it down:

1. It simplifies complex processes

This smart online system organizes all your customer info. It’s a digital drawer where all your customer chats, preferences, and histories are stored. You won’t lose track of any detail.

2. It supercharges sales

See all the deals that are about to close and those that are needing a little push, all in a tailored dashboard. It’s sort of a visual GPS, guiding you on which sales routes to take.

3. It gives intelligent insights

Knowledge is power, right? Capsule offers easy-to-understand reports, spotlighting activities that are influencing your sales the most. You’re always two steps ahead in strategizing your next move.

4. It automates tasks

We all hate busy work, but thankfully Capsule’s automation feature reduces manual tasks. This gives you more time to focus on what truly matters – connecting with customers and improving the company’s operational efficiency.

5. It’s flexible and personalized

Every business is unique, and Capsule understands that. It comes with a Teams plan that adapts to your way of doing things. Advanced sales reports? Workflow automation? Or maybe AI content assistance? It’s got all the right features to suit your rhythm.

Use the free version of Capsule CRM to see how it works in practice. Upgrade your plan anytime you feel like it! It’s available for up to two users and 250 contacts.

Get started for free, or take a look at the subscription plans to see which one you like best.

Key Takeaways

- Use Capsule CRM to make your return on sales ratio go up.

- Return on sales (ROS) insight is a metric that indicates how much profit a company earns from its sales. High ROS means the company controls costs and maximizes profits, while low ROS might suggest challenges in managing operating costs from core operations.

- Practices such as building on existing customer relationships, optimizing stock levels for demand-supply balance, and using predictive analytics all impact operating cash flow and operating profit margin.

- Apart from return on sales, another financial ratio worth noting is the gross profit margin. It depicts profitability by subtracting the cost of goods sold (COGS) from profit, giving a clearer picture of core operations.

Return on Sales concluded

Paying attention to this metric makes the difference.

Get the most out of your business by following our best practices.

Organize and manage your contacts with Capsule CRM.

Still not sure? Capsule CRM offers a 14-day trial without the need for a credit card. Sign up, explore, and see if it's the right fit for you.