Who needs a balance sheet, right? Wrong! Every small business needs one to track their finances like a pro.

Here are five killer small business balance sheet templates to streamline your accounting and keep those finances crystal clear. Don’t just wing it—get organized and watch your business thrive.

What is a balance sheet?

A balance sheet is a financial snapshot that shows what your business owns and owes at a specific point in time. It includes three main components: assets, liabilities, and equity, which are often further broken down into categories.

With this document, you can better understand your business’s financial health.

More advanced balance sheet templates can also contain:

- Detailed breakdown of assets: Including current assets like cash, accounts receivable, inventory, and long-term assets like property, equipment, and investments.

- Segregated liabilities: Distinguishing between current liabilities (due within a year), such as accounts payable, and long-term liabilities, like loans and mortgages.

- Owner's equity section: Detailed equity components, such as retained earnings, common stock, and additional paid-in capital.

- Comparative analysis: Columns for current and previous periods to easily compare financial positions over time.

- Notes section: Explanations for significant changes, accounting policies, and other relevant details that provide context to the figures.

- Ratios and metrics: Key financial ratios such as current ratio, quick ratio, and debt-to-equity ratio for quick assessment of financial health.

- Budget vs. actual comparison: Including columns for budgeted figures versus actual figures to track performance against financial plans.

Balance sheets are often confused with various other financial documents such as income statements.

Balance sheet vs. income statement: What's the difference?

These two financial statements provide distinct insights into your business’s financial health, but they differ vastly. Let’s break down how they are similar and how they differ to give you a clear picture.

Similarities

- Both are essential financial statements for any business.

- They provide insights into a company’s financial performance.

- They help in decision-making and strategic planning.

- Investors and stakeholders use both to assess financial health.

- They are typically prepared periodically, such as quarterly or annually.

- Both require accurate and thorough bookkeeping.

- They must comply with standard accounting principles and practices.

Differences

- A balance sheet shows assets, liabilities, and equity, while an income statement shows revenues and expenses.

- The balance sheet provides a snapshot at a specific point in time; the income statement covers a period of time.

- Income statements reflect profitability, whereas balance sheets reflect financial position.

- The balance sheet helps assess liquid assets and solvency, while the income statement assesses operational efficiency.

- Income statements include operating and non-operating revenues and expenses; balance sheets do not.

- The balance sheet includes both short-term and long-term data, while the financial statement focuses on short-term results.

- Investors use balance sheets to assess capital structure, while they use income statements to evaluate earnings performance.

In summary, a balance sheet assesses your company's overall financial position, showing what you own and owe at a specific point in time.

On the other hand, an income statement evaluates your company's profitability over a period and details revenues and expenses.

Knowing how to read and interpret both will empower you to make better financial decisions and set your business on the path to success.

Why do I need a balance sheet?

A balance sheet is your financial reality check. It shows what you own, what you owe, and what’s left over for you.

Need to impress investors? They’ll want to see your balance sheet.

Planning to apply for a loan? The bank will ask for it.

Even if you’re just trying to keep track of your own finances, a balance sheet is essential. Here's why:

First, it gives you a snapshot of your financial health at any given moment.

You can see your assets, liabilities, and equity all in one place. You need this view to make informed decisions about your business. Are you thinking about expanding or investing in new equipment? Your balance sheet will tell you if you have the resources to do so.

Second, it’s a must-have for securing financing.

Banks and investors will want to see your balance sheet to understand your company's financial health before they lend you money or invest in your business. A well-prepared balance sheet shows that you’re serious and organized, which only makes it easier to gain their trust.

Third, a balance sheet helps you monitor your business’s performance over time.

By comparing balance sheets from different periods, you can identify trends and make adjustments to improve your financial stability. It’s like having a financial dashboard that helps you steer your business in the right direction.

Fourth, it aids in maintaining accurate records for tax purposes.

A clear record of your assets, liabilities, and equity can simplify the tax filing process and help you avoid costly mistakes.

Lastly, a balance sheet helps immensely with internal management.

As a result, you can monitor your company's liquidity and make sure there's enough money to pay all of your bills. This can prevent cash flow problems that might otherwise derail your operations.

5 customizable small business balance sheet templates

Generic templates might seem convenient, but they often miss the mark for your unique business needs. Instead, let’s dive into five customizable small business balance sheet templates that put you in control.

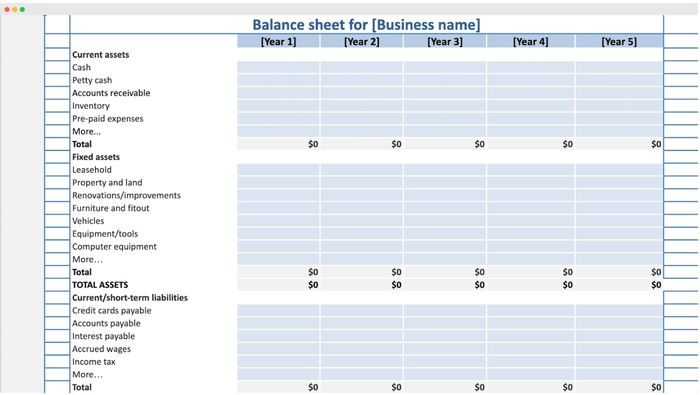

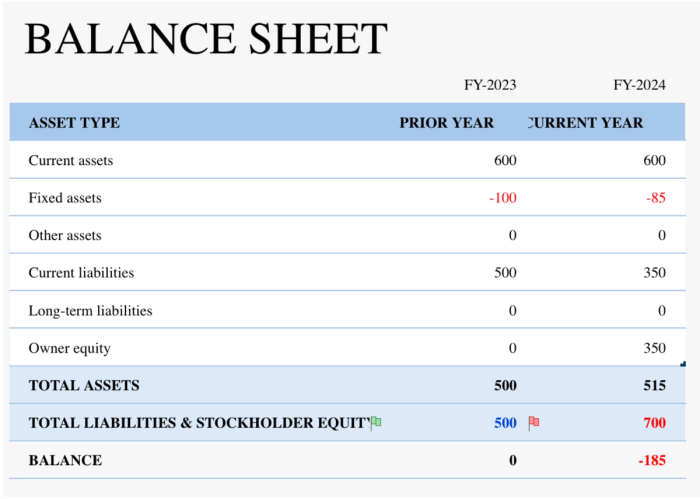

#1 Basic balance sheet template

The basic balance sheet template provides a comprehensive structure to record your small business's financial information. The template includes sections for:

- Current assets: Cash, petty cash, accounts receivable, inventory.

- Non-current assets: Property, plant, and equipment, intangible assets, investments.

- Current liabilities: Accounts payable, short-term loans, and taxes payable.

- Non-Current liabilities: Long-term debt.

- Equity: Owner's equity, retained earnings.

To use it, download the template, access it online or offline, and fill in the relevant financial data for each category (assets, total liabilities, and equity) across the provided years. Maintain the balance sheet by updating it periodically to reflect your company's financial position.

It's best to use it:

- During financial reviews.

- When applying for loans.

- For regular business performance evaluations.

- For preparing tax returns.

- When seeking investment or funding.

- For internal audits.

- For strategic planning and decision-making.

Access and customize the template here.

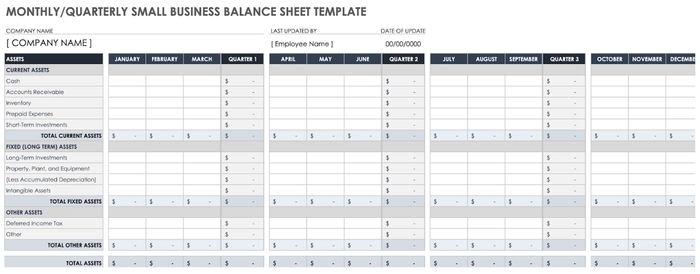

#2 Quarterly balance sheet template

The quarterly balance sheet small business template provides a detailed financial tracking mechanism specifically designed for monthly and quarterly assessments. It includes sections for:

- Current and fixed assets: Cash, petty cash, accounts receivable, inventory, property, plant, and equipment, intangible assets, investments.

- Liabilities: Accounts payable, short-term loans, taxes payable, and long-term debt.

- Equity: Owner's equity, retained earnings.

With separate columns for each month and quarter, this template is made for more frequent financial monitoring. It's perfect for businesses that need to do regular and detailed financial assessments.

Access and customize the template here.

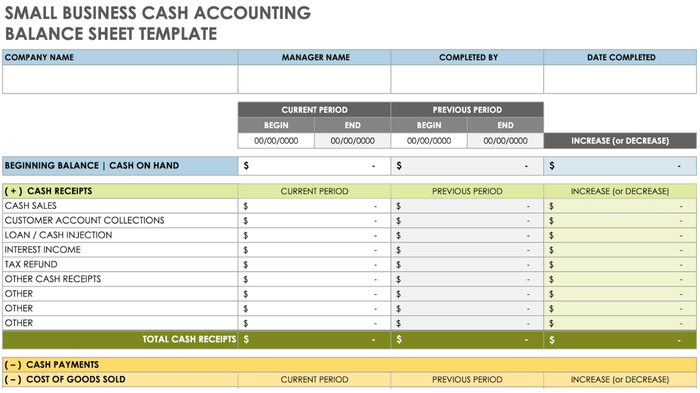

#3 Cash flow balance sheet template

The small business cash accounting balance sheet template is a detailed cash flow template designed to track cash inflows and outflows over specific periods. Here is a breakdown of its components:

- Beginning balance | Cash on hand: This section records the starting cash balance at the beginning of the period.

- Cash receipts:

- Cash sales: Income from direct sales.

- Customer account collections: Payments received from customers on account.

- Loan / cash injection: Funds received from loans or additional investments.

- Interest income: Earnings from interest.

- Tax refund: Any tax refunds received.

- Other cash receipts: Additional unspecified sources of cash inflows, with placeholders for further specification.

- Cash disbursements:

- Purchases: Payments for inventory or materials.

- Payroll: Salaries and wages paid to employees.

- Operating expenses: General business expenses.

- Loan payments: Payments made towards loans.

- Capital expenditures: Investments in long-term company's assets.

- Taxes paid: Payments for taxes.

- Other cash payments: Additional unspecified cash outflows, with placeholders for further specification.

To use it, simply fill in the relevant financial data for each category (beginning balance, cash receipts, and cash disbursements) for the current and previous periods.

The cash flow template is made to help you keep track of your cash flow by recording all of your cash coming in and going out.

With this template you get a more detailed look at cash transactions, which makes it very useful for companies that need to keep an eye out on their cash flow.

Access and customize the template here.

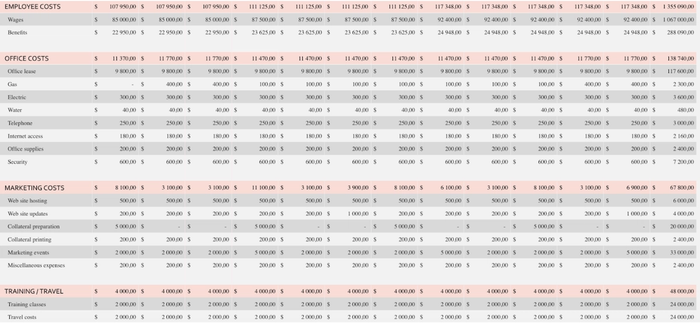

#4 Small business expenses sheet template

- The business expenses budget template is a comprehensive tool designed to help you plan, track, and analyze their expenses over time. It is divided into four main sections:

- Planned expenses:

- A detailed breakdown of anticipated business expenses for each month.

- Categories like rent, utilities, salaries, marketing, and other operational costs.

- Actual expenses:

- Records of actual expenditures incurred each month.

- Same categories as the planned expenses for easy comparison.

- Expense variances:

- Calculates the differences between planned and actual expenses.

- Highlights over- or under-spending in each category.

- Expenses analysis:

- Provides a summary and analysis of expenses over a selected period.

- Includes visual aids like graphs or charts to illustrate spending patterns.

Standard balance sheets show a quick picture of your business’s finances. In contrast, this template is all about the budgeting process. It stresses planning and keeping track of expenses.

You can better manage their money by comparing planned and actual spending and figuring out how to better control costs.

Access and customize the template here.

#5 Year-on-year small business balance sheet template

A 5-year, year-on-year small business balance sheet template is a comprehensive financial document that tracks the assets, liabilities, and equity of a small business over a period of five years.

This template includes sections for:

- Assets:

- Current assets: Cash, investments, inventories, accounts receivable, prepaid expenses.

- Fixed assets: Property and equipment, leasehold improvements.

- Other assets

- Liabilities:

- Current liabilities: Accounts payable, accrued wages, accrued compensation, income taxes payable, unearned revenue.

- Long-term liabilities: Mortgage payable.

- Equity:

- Owner equity: Investment capital, retained earnings.

To use this template, start by entering your financial data for each fiscal year into the corresponding sections for assets, liabilities, and equity. Ensure to update the figures at the end of each fiscal year to maintain an accurate record.

This balance sheet is best used at the end of each fiscal year or quarter to provide a snapshot of the business's financial health and to plan for future financial decisions.

Unlike single-year balance sheets, this template provides a longitudinal view, which allows businesses to see trends and patterns over a longer period of time.

Access and customize the template here.

Tips for effective balance sheet management

Balance sheet management does not end with inputting the numbers. You need to keep in mind a few things:

Observe the numbers

First things first, regularly review your balance sheet. It’s like a financial selfie—snapshots of your business’s health. Look for trends in total assets, liabilities, and equity to spot potential issues before they become big problems.

Example: If you notice that your accounts receivable is increasing while cash reserves are dwindling, it may signal that customers are taking longer to pay. You might then want to implement stricter credit policies or follow up more aggressively on overdue invoices.

Manage your debt wisely

Aim for a balanced debt-to-equity ratio. Too much debt? You might be walking a tightrope. Too little? You could be missing out on growth opportunities. Find that sweet spot!

Example: Suppose your business has a debt-to-equity ratio of 2:1, indicating high debt levels. To manage this, you could focus on paying down existing loans while seeking equity financing for expansion. Conversely, if your ratio is 0.2:1, you might consider taking on a manageable amount of debt to invest in growth opportunities, such as new equipment or marketing campaigns.

Optimize your inventory

Don’t let excess inventory drain your cash flow. Use smart forecasting to keep just enough stock on hand. Cash is king, and you want to keep it flowing.

Example: Imagine a retail store that finds itself with a surplus of winter clothing as spring approaches. By using sales data to forecast demand more accurately, the store can adjust its inventory levels. For instance, they could run a promotion to clear out excess stock.

Speed up collections

Get those invoices paid! Implement a solid follow-up process and consider offering discounts for early payments. The sooner you collect, the healthier your cash flow statement.

Example: If your business has a collection period of 60 days, consider offering a 5% discount for customers who pay within 10 days. With this incentive, you can encourage faster payments and reduce the time your capital is tied up in receivables.

Negotiate with suppliers

Don’t be afraid to ask for better payment terms with your suppliers. Extended terms can give you more breathing room and help manage cash flow effectively.

Example: If you currently pay your suppliers within 30 days, try negotiating for 45-day payment terms. The extra time can improve your cash flow, and allow you to use that capital for other immediate expenses or investments.

By staying proactive and strategic, you’ll keep your balance sheet in tip-top shape and set your business up for success!

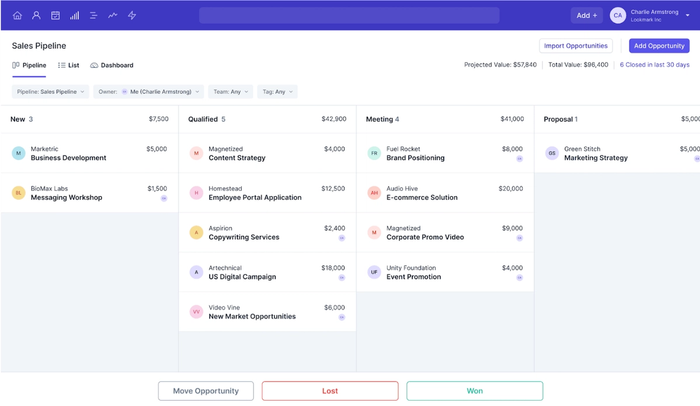

Spreadsheets not cutting it? Upgrade to Capsule CRM!

Forget your typical balance sheet! Who wants to juggle endless tabs and cells when you can keep all your financials in one sleek platform?

Check out Capsule CRM – your all-in-one solution for hitting that financial sweet spot without the headache.

Capsule CRM brings all your financial data under one roof and lets you wave goodbye to the chaos of multiple spreadsheets. With its powerful integrations with Xero, FreshBooks, and QuickBooks, managing your finances has never been easier.

You get consistent syncing of all your financial transactions, invoices, and reports directly into your CRM. No more double entry, no more missed details – just smooth, effortless financial management.

Capsule’s integration with the small business accounting software Xero allows you to track and reconcile your business's financial position with precision.

QuickBooks users? Capsule has got you covered too, with features that help you manage sales, expenses, and everything in between.

And the best part? Capsule CRM offers a free-forever version packed with most features you’ll need to get started. You can enjoy powerful CRM capabilities without spending a dime.

Ready to optimize your financial management and ditch the spreadsheets for good? Check out Capsule’s free version here. Your future self will thank you!

Frequently Asked Questions

To create a balance sheet for a small business, list all current assets, long-term business's assets, current liabilities, and long-term liabilities. Calculate total assets and total liabilities, then determine the owner's equity. This financial statement reflects the company's assets and financial position, helping business owners make informed decisions.

A sample balance sheet is a financial statement for small businesses, detailing the company's assets, liabilities, and shareholder equity. It includes current assets like cash and bank accounts, and liabilities such as short-term and long-term business loans. This simple balance sheet helps in understanding the financial health and net worth of the business.

A balance sheet in SMEs (Small and Medium Enterprises) is a financial statement showing the company's assets, liabilities, and owner's equity. It includes line items like current short-term assets, long-term assets, current liabilities, and long-term liabilities, helping assess the business's financial position and overall financial health.

A good business balance sheet has balanced total assets and total liabilities, indicating strong financial health. It includes substantial current and non-current assets, manageable current liabilities, and reflects a positive owner's stake. This balance sheet helps business owners make strategic business decisions and demonstrates financial stability.

Yes, you can create a balance sheet for yourself. List your assets (bank accounts, tangible assets), liabilities (debts owed), and calculate your net worth. This personal balance sheet helps understand your financial position, monitor your finances, and make informed financial decisions, similar to a business's balance sheet.

To manually create a balance sheet, start by listing your company's assets (current and long-term), then list liabilities (current and long-term). Calculate total assets and total liabilities, then determine owner's equity by subtracting total liabilities from total assets. This accounting process helps in assessing the company's finances.

![Business statistics every business owner should know [2026]](https://cdn.sanity.io/images/poftgen7/production/5619faf6a65f53406d3e554c11c9e894402d4397-5760x3240.jpg?rect=5,0,5751,3240&w=300&h=169&q=75&fit=max&auto=format)