Running a small business means wearing many hats, but when it comes to managing your data, you don't have to reinvent the wheel

For staying organized and on top of your game, a simple spreadsheet can be a game changer.

If you are running a small business, these 10 useful spreadsheet templates will make things run more smoothly. From tracking expenses to forecasting sales, these ready-to-use templates are about to become your new best friends.

Let's take a peek inside and see what wizardry you can do with spreadsheets.

Why use spreadsheets for business management?

Many businesses cannot imagine their everyday operations without spreadsheets. But considering the range of benefits it comes as no surprise, let's look at these in more detail:.

- First off, they're budget-friendly. Most businesses already have access to spreadsheet software, so there's no need to shell out for fancy new tools. They're pretty straightforward to use. With minimal training, anyone can start crunching numbers and organizing data.

- Collaboration is a piece of cake, too. With cloud-based tools like Google Sheets, everyone on the team can work on the same document at the same time. Also, don’t forget about data visualization. It only takes a few clicks to turn raw data into interesting charts and graphs.

- Customization is easier with spreadsheets. No matter if you are keeping track of costs, managing inventory, or predicting sales, you can change the sheets to fit your needs. Apps Script exists for you to set any spreadsheet up exactly to your requirements. You could be surprised about the wide range of things you can do in Google Sheets with simple programming!

Spreadsheets are great for making financial records, too. They can help you with everything from balance sheets to cash flow statements. You can find a huge number of templates online, so you do not have to start from scratch, either.

Even though they are not the most flashy tool, spreadsheets are still a good choice for companies that want to stay organized.

That being said, we curated a special list of over 10 spreadsheet templates designed to track important info, such as financial data or marketing plans, for small and medium businesses.

10+ spreadsheet templates for small business owners

There are tons of templates to choose from all over the internet. We've listed what we think are the most important ones for small businesses! All you need to do is fill in the details, and the spreadsheet will automatically calculate everything you need.

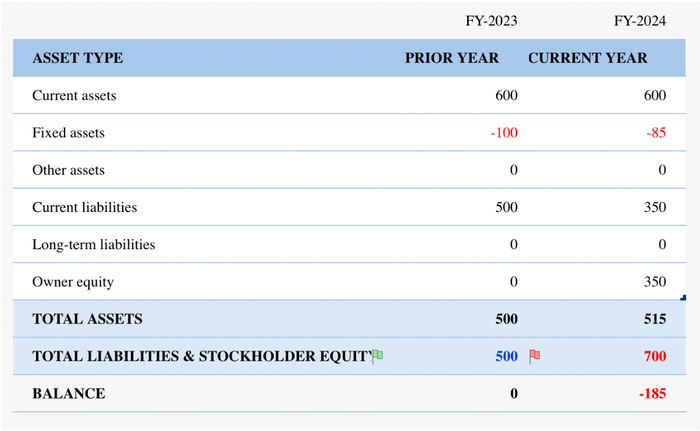

#1 Balance sheet template

The balance sheet is a must-have tool for any small business owner. It offers a clear snapshot of your company's financial health by detailing your assets, liabilities, and equity. Here's what you'll get with this template:

- Assets: Cash, inventory, equipment, investments, and more.

- Liabilities: Loans, accounts payable, accrued wages, unearned revenue, and more.

- Equity: Owner's investment capital and retained earnings.

Keep your balance sheet up to date, and you will always have a clear picture of your finances to make better business decisions. It's your go-to document for tracking what you own and owe.

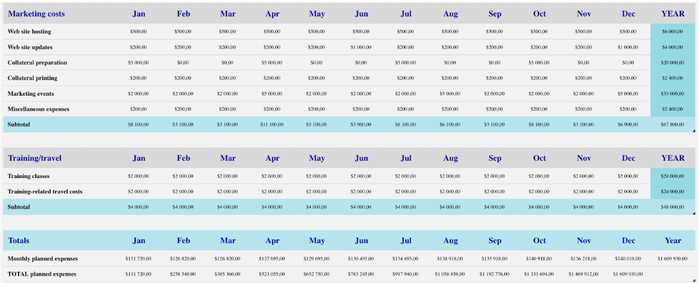

#2 Business expenses template

As the name indicates, a business expenses template can help you manage costs related to business operations. Want to track your planned and actual expenses, along with variances? This template has got you covered.

The business expenses template is also useful for getting a so-called helicopter view of your costs. You can track many expenses, such as:

- Employee: Wages and benefits.

- Marketing: Website hosting and management, collateral preparation, events, and miscellaneous expenses.

- Office: Lease, gas, electric, water, internet access, etc.

- Training and travel: Training classes and training-related travel costs.

Simply fill in your company name and logo, then enter details in the planned and actual expenses tables. The template automatically updates the expense variances and generates charts in the expense analysis worksheet.

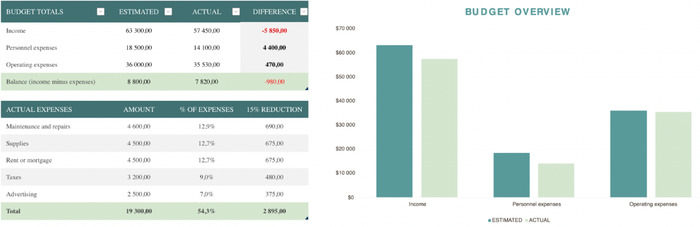

#3 Income and expense sheet template

All businesses need to keep an eye on their income and expense comparisons. This template provides a monthly budget summary – and breaks down your income and expenses in a clear, organized way. It features key elements, like:

- Income: Net sales, interest income, asset sales, and total income.

- Personnel expenses: Wages, employee benefits, commissions, and total personnel costs.

- Operating expenses: Advertising, maintenance and repairs, supplies, rent or mortgage, taxes, and more.

How do you balance it all? By subtracting your total expenses from your income, you get a clear picture of your financial health. With this template, you can see where you might need to optimize business processes to save costs.

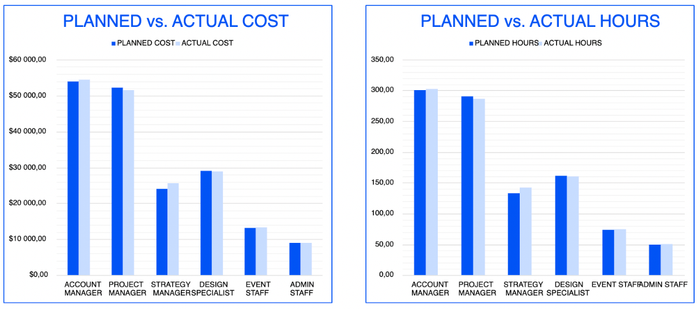

#4 Event budget template

Planning a company event? Luckily, this event budget template can be your handy tool for keeping track of every detail.

Use it to break down costs from services like catering and speakers through advertising to venue fees. Compare estimated costs versus actual expenses and income across various categories such as:

- Event strategy,

- planning,

- design,

- logistics,

- staffing,

- assessment.

You can track project parameters, details, and totals quickly and easily with this template. Enter data in the table to automatically update column charts. Need to add a row? Just select the bottom-right cell of the table and press Tab, or right-click to insert a row. Don't forget to delete unused rows to confirm accurate project totals.

With this template, you'll always stay within your event budget.

#5 Performance report template

For precise tracking, you can use an Excel spreadsheet to create a detailed project performance report.

Inside, there is a definitions worksheet that will guide you on terminologies and formulas.

With this template, you can record the high-level status of multiple projects and compare estimated and actual budget costs with ease. Conditional formatting helps you estimate costs at granular levels.

Key metrics include:

- Budget at Completion (B.A.C.): The baseline project cost.

- Actual Cost (A.C.): Total costs incurred in completing work during a given period.

- Earned Value (E.V.): The physical work completed during a given period.

- Planned Value (P.V.): The physical work scheduled for completion during a given period.

- Cost Performance Index (C.P.I.): The cost efficiency ratio.

Just plug in your data and let this template do the heavy lifting. The performance report template will help you keep your projects on track.

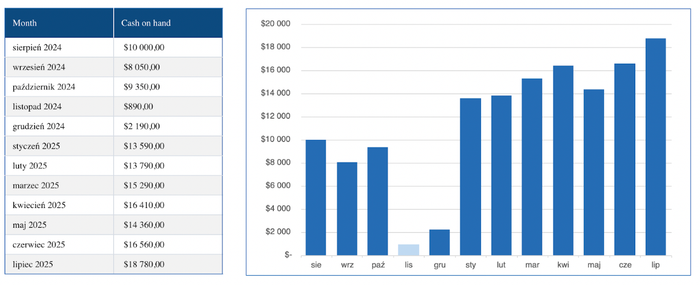

#6 Capital forecasting template

Want to know if your business's cash flow can meet your financial obligations? Well, a capital forecasting Excel template is here to help. Your capital numbers can be easily entered into this template, which then does instant calculations and even makes a chart to show your monthly balances. Some important parts of it are:

- Starting cash on hand: Track your cash at the beginning of the month.

- Cash receipts: Include cash sales, collections on accounts receivable, and other income.

- Total cash available: Sum up your starting cash and cash receipts.

- Cash paid out: Detail all expenses, from advertising to wages.

- Ending cash balance: See your cash on hand at the end of each month.

- Loan proceeds: Include any incoming business loan funds.

- Owner contributions: Record additional funds contributed by the owner.

- Other operating data: Monitor sales volume, accounts receivable balance, and inventory on hand.

All you need to do is insert your company name, starting cash on hand, starting date, as well as a cash minimum balance alert. Plug in the rest of your data, and the spreadsheet does the rest. The result is an informative chart of your cash flow.

#7 Company itinerary expenses template

Without proper budget planning, work trip-related expenses can be a headache to calculate. This business trip budget template helps you plan and record all the costs of any business trip, such as travel fares, hotels, dining, transportation, and more. Simply enter the trip details in the data table, and the template will automatically calculate the total trip cost and balance.

Some of the key elements of this template include:

- Target trip budget: Set your budget and track it easily.

- Total cost of the trip: Automatically calculated for accuracy.

- Expense categories: Include airfare, hotel, car rental, gas, entertainment, gifts, miscellaneous, and food.

- Budget status: See if you’re under budget at a glance.

Company trips can get pricey fast. The right template will save you budget headaches later on.

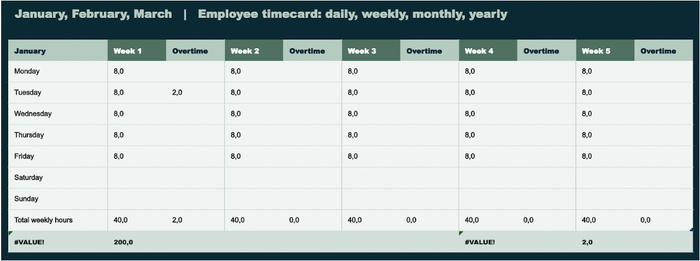

#8 Employee timesheet template

Track work hours – daily, weekly, monthly, and annually – with this comprehensive employee timecard. Start by filling in basic information such as employee name, manager name, email address, and phone number.

Log your hours in the monthly tables, with separate columns for regular and overtime hours for each weekday of each week. The template automatically calculates total working hours, regular hours, and overtime hours.

This yearly timesheet gives you a complete overview of all your working hours and those of your employees. You will no longer be lost in the dark with your work schedule!

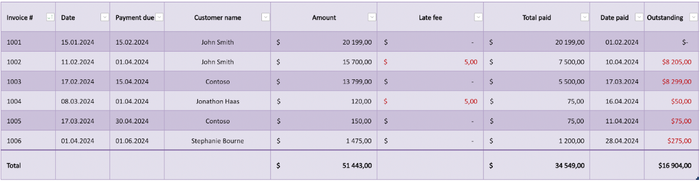

#9 Invoice tracking template

This invoice tracking template is an easy way to organize all your bills. It lets you manage and keep an eye on all your invoices in one place, so you never miss a payment.

Speed up your billing process, avoid late payments, and keep your cash flow healthy by overseeing the details of each invoice. This way, you can easily see what's been paid and what is still due.

Record the invoice number, date, payment due date, customer name, amount, late fee, total paid, date paid, and outstanding balance. The totals will be calculated for you.

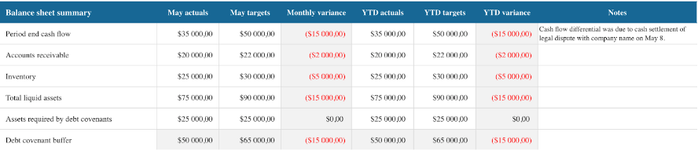

#10 Budget summary template

Want a clear snapshot of your company’s financial health? This budget summary template provides a comprehensive overview of your profit and loss, balance sheet, and key operating metrics. It’s perfect for quickly assessing your business performance. The template has the following elements:

Profit and loss summary

- Revenue: Track total income.

- Gross margin and percentage: See profitability.

- Sales from new products: Gauge innovation impact.

- Regional sales breakdown: Northeast, Central, West regions.

Expenses & margin

- SG&A expenses: Monitor operating costs.

- Pretax operating profit (loss): Measure performance before taxes.

- Operating margin: Evaluate profitability.

Balance sheet summary

- Period end cash flow: Track liquidity.

- Accounts receivable and inventory: Manage assets.

- Total liquid assets: Assess cash on hand.

- Debt covenant buffer: Ensure financial compliance.

Operating metrics summary

- Production quality: Defects per 1,000 units.

- Capacity: Units per month.

- Sales performance: New orders and days outstanding.

Competitive summary

- Market share and revenue (YTD): Measure market position.

- New product introductions (YTD): Track innovation.

- Field salespeople: Estimate sales force size.

You also get automated charts for profit and loss and balance sheet summaries, which make this template a powerhouse for financial tracking.

Bonus: 3 essential marketing templates

Expense tracking is not the only thing you can do with spreadsheets. They can also be used for marketing and sales and can aid in better alignment. These are three examples of such usage:

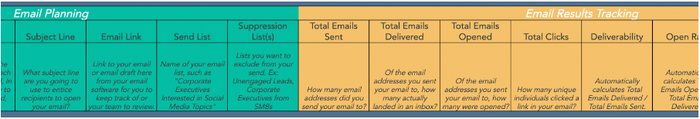

#1 Marketing planner template

Would you like your email marketing campaigns to be more effective? This marketing planner template is just what you need. It’s divided into three sections: Email Planning, Email Results Tracking, and A/B Testing Planning & Results.

How to use it:

- Email Planning: Plan out each campaign, including content, design, and timing.

- Email Results Tracking: Keep track of key metrics like delivery, open, and clickthrough rates.

- A/B Testing: Plan and track your A/B tests to optimize your emails.

It helps you organize, execute, and analyze your email campaigns efficiently.

The template includes columns for various components with descriptions, auto-populating cells for metrics, and a customizable layout to fit your needs. Also, you can easily add rows or duplicate the template for new months.

#2 Marketing overview template

If you need a comprehensive overview of your marketing performance, this template is designed for you. Data can be accessed for up to 5 years or 260 weeks, which provides a comprehensive picture of your marketing efforts over time.

At the end of each week, enter your latest metrics in the shaded spaces of the Datasheet. Look up the current week's starting date in column A, then fill in columns C-Z. Check the notes in row 3 for specific instructions on each column.

Some key parts of this template are:

- Google ad spend

- Number of visitors and single-page visits

- Emails sent and opened

- Email contacts and subscribers

- Ad spend across Facebook, Instagram, Twitter (X), LinkedIn, YouTube

- Social media followers and likes

- Sales sourced from various channels

Your report could look like this:

Automated chart updates make it easy to see your performance over time. With the marketing overview, you can gain many invaluable insights that will change your business outlook.

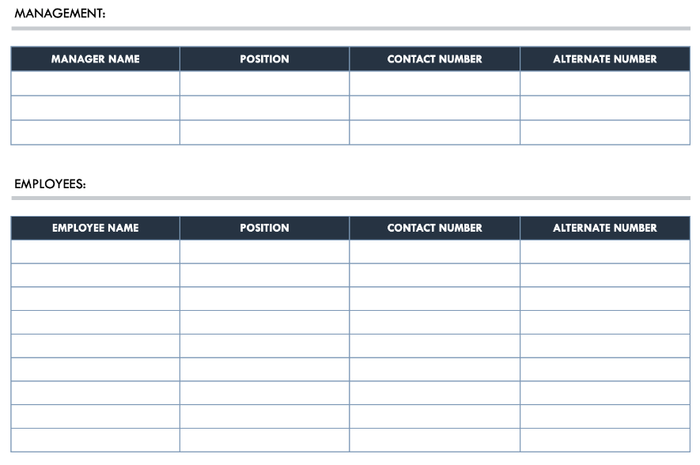

#3 Contact list template

It can be challenging to manage contact information efficiently. Luckily, there are many solutions, and spreadsheets are one of them. You can use this template to create your own contact list.

Why is it so important? Keeping an organized contact list helps optimize your outreach efforts and guarantees that no lead falls through the cracks.

Here’s what’s included in the template:

- Name: Full names for personalized communication.

- Company: Affiliation for context.

- Position: Job title to tailor your approach.

- Email: Primary mode of communication.

- Phone number: For direct contact.

- Notes: Additional information or follow-up details.

Using this template, you can easily manage and build a comprehensive list of prospects for more efficient marketing and sales efforts.

However, as time goes by, you will find that such templates might not be enough.

When you get to that point, consider switching to a CRM, even a free one. A CRM has all the capabilities spreadsheets do, and more.

Small business spreadsheet expense tracking best practices

Keeping tabs on your small business expenses doesn't have to be a headache. With the right spreadsheet tactics, you can turn expense tracking from a dreaded chore into an efficient process. What should you do?

Choose the right platform

When it comes to tracking expenses, you will need the right platform. How do you decide? Consider your needs and the features of each tool.

Google Sheets is a great option if you want a free, user-friendly tool that allows easy sharing and real-time collaboration. Why? It’s accessible from anywhere, and pretty much everyone knows how to use it.

On the other hand, Microsoft Excel offers more advanced features and powerful data analysis tools, ideal for detailed financial tracking and complex calculations.

Assess your business requirements and decide whether ease of use or advanced capabilities are more important. This choice can speed up your expense tracking and improve financial management.

Set up a clear structure

To ensure effective expense tracking, start with a clear structure in your spreadsheet. A well-organized layout allows for easy data retrieval and accurate analysis, which reduces errors and saves time.

Create columns for:

- Date: When the expense occurred.

- Expense category: Classify the type of expense (e.g., office supplies, travel, accommodation).

- Amount: The cost of the expense.

- Payment method: How the payment was made (e.g., credit card, cash, PayPal).

- Notes: Additional details about the transaction.

Each transaction should have its own row to guarantee detailed and organized records. With a clear setup, you can quickly identify spending patterns, adjust your cash flow, manage budgets, and make informed financial decisions.

Customize categories

To make expense tracking more effective, customize your expense categories to fit your specific business needs. Tailoring categories helps with tracking and gives you a lot more financial insights.

Start with common categories and adapt them to your business:

- Operating expenses: Rent, utilities, office supplies.

- Capital expenses: Equipment purchases, and property investments.

- Cost of goods sold: Raw materials, production costs.

- Marketing expenses: Advertising, promotional materials.

- Employee expenses: Salaries, benefits, training.

- Travel expenses: Flights, accommodation, meals.

- Miscellaneous expenses: Unexpected costs, sundry items.

Customized categories help you see how you spend your money more clearly and filter and sort data more easily. This way, you can conduct more targeted strategic planning and financial analysis.

Keep your information detailed

It is easier to look over and manage your money when you keep accurate and detailed records.

Be sure to include these elements in each of your records:

- Precise date: Know exactly when the expense occurred.

- Full transaction amount: Record the exact cost.

- Vendor name: Identify where the money was spent.

- Brief description: Note what the expense was for.

Adding these details to your financial tracking makes it clearer and more comprehensive. You can quickly spot discrepancies, track income, shorten audits, and prepare for taxes with ease.

Create summary tables

You need a clear overview of your business finances. Luckily, summary tables are here to help. They give you a quick look at your finances, which makes tracking expenses much easier.

Compile monthly expense totals and create an annual summary table. Break down the year-to-date totals across different categories such as operating expenses, marketing costs, and travel expenses. Here’s what to include:

- Monthly expenses: Track expenses month by month.

- Category breakdown: Operating expenses, marketing costs, travel expenses, etc.

- Subcategories: More detailed splits, such as office supplies under operating expenses.

- Year-to-date totals: Cumulative expenses for the year.

- Variance: Compare actual costs against budgeted amounts.

- Percentage of total: Each category’s share of total expenses.

- Monthly averages: Average expenses per month for each category.

- Graphical representation: Charts and graphs for visual insights.

It is a smart way to quickly compare monthly and yearly costs so you can make better budgeting choices. Summary tables simplify financial analysis and help you stay on top of your business's finances.

Audit regularly

Regular audits help you catch discrepancies and detect potential issues early. They also verify the accuracy of your financial statements and help with regulatory compliance.

What should you do? Conduct periodic reviews of your expense data by:

- Checking for inconsistencies: Compare receipts and invoices with recorded expenses.

- Ensuring policy compliance: Verify that all expenses align with your company’s expense policy.

- Detecting unusual patterns: Look for irregularities that might indicate errors or fraud.

- Reviewing expense categories: Confirm that expenses are correctly categorized.

With regular audits, you gain the trust of your stakeholders and keep your business running smoothly.

Consider automation

While spreadsheets are useful, have you considered using expense-tracking apps or software? Automation offers advanced features like receipt scanning and smooth integration with accounting systems. You will also get to keep everything in one place instead of jumping back and forth between different spreadsheets.

You can easily upload receipts, categorize expenses, and sync with your financial software, which means no more manual entries or lost receipts. Automated systems can also generate insightful reports, which can help you make educated decisions quickly.

What should you look for in an expense tracking tool? Consider features like:

- Receipt scanning: Easily upload and categorize receipts.

- Automatic categorization: Save time with intelligent expense sorting.

- Integration with accounting software: Confirm your financial data is always up-to-date.

- Real-time updates: Monitor expenses as they occur.

- Mobile app accessibility: Manage expenses on the go.

- Multi-user support: Allow team members to submit expenses.

- Customizable reports: Generate reports tailored to your needs.

- Expense approval workflows: Unify approval processes.

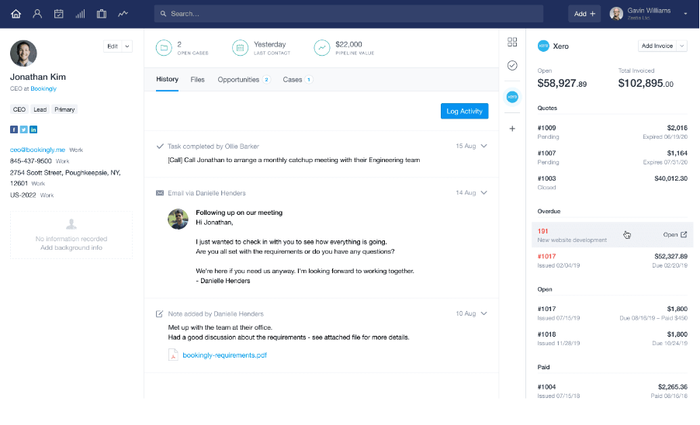

For example, Capsule CRM is an excellent tool that integrates seamlessly with Xero, a leading accounting system. With this integration, your financial data is always up-to-date and easy to get to, so you can keep a good eye on your business's money.

Stay on top of expenses with Capsule CRM

Managing your business expenses just got easier with Capsule CRM’s integration with Xero. This connection allows you to sync customer data, track invoices, and manage payments all in one place.

To give you a full picture of your finances, Capsule CRM and Xero work together to coordinate your leads, create invoices, and keep track of payments. Capsule CRM also integrates with QuickBooks and FreshBooks.

You can access payment due dates, invoice statuses, and estimates directly from Capsule CRM without switching platforms. With this integration, your records for customers and suppliers are also kept up to date automatically, which cuts down on mistakes and saves time.

Capsule CRM offers features such as:

- Instant access to invoice summaries and overdue amounts: Right next to your customer records.

- Automated record updates: Capsule is treated as the source for contact data.

- Streamlined workflow: Add customers directly to Xero from Capsule.

- Comprehensive financial overview: Prioritize workloads with a complete financial picture.

Ready to clarify your expense management and improve financial accuracy? Try Capsule CRM’s integration with Xero now!